Legal Section

Published in 3rd Quarter 2017

2015 C L D 1184

[Lahore]

Before Ch. Muhammad Masood Jahangir and Ch. Muhammad Iqbal, JJ

Mst. SHAFIA BIBI—Appellant

Versus

STATE LIFE INSURANCE CORPORATION and Others—Respondents

Insurance Appeal No.413 of 2014 heard on 22nd January, 2015.

Insurance Ordinance (XXXIX of 2000) —

—Ss. 118 & 122—Limitation Act (IX of 1908) Ss 19, 149 & Art. 86(a)—Civil Procedure Code (V of 1908), O VII, R. 11 —Life insurance claim—Computation of period of limitation—Effect of acknowledgment in writing in relation to life insurance claim—Application of claimant for liquidated damages was rejected by Insurance Tribunal on the ground that the same was barred by time—Contention of claimant was, inter alia, that fresh period of limitation would be computed from the time the main life insurance claim was paid in compliance of the direction of the Federal Ombudsman, therefore application of claimant for liquidated damages was filed within time—held, that the insurance policy commenced on 31-08-2007 whereas the insured died on 27-12-2007 and claim of claimant was repudiated on 25-11-2008 by the Insurance Corporation after which claimant filed complaint before Federal Ombudsman which was conclude on 6-2-2010 and in compliance thereof , the main life insurance claim amount was paid to the claimant on 25-5-2012 when claim was paid without liquidated damages; as the same amounted to acknowledgment of liability and S. 19 of the Limitation Act, 1908 was therefore applicable to the present case—Even otherwise question of limitation was a mixed question of law and facts and same could not be adjudged without recording of evidence and the Insurance Tribunal failed to consider applicability of Ss. 14 & 19 of the Limitation Act, 1908 and application of the claimant could not be summarily rejected while applying Art. 86(a) of the Limitation Act, 1908—Article 86(a) of the Limitation Act, 1908 would be applicable if the claim of the claimant was payable, whereas, in the present case claim of the claimant was repudiated, and such aspect of the case was ignored by the Insurance Tribunal while passing impugned order—High Court set aside impugned order and remanded the case to the Insurance Tribunal for decision afresh—Appeal was allowed, accordingly.

Mst. Robina Bibi V. State Life Insurance Corporation of Pakistan 2013 CLD 477 rel.

Liaqat Ali Butt for Appellant.

Ibrar Ahmad for Respondents.

Date of hearing: 22nd January, 2015.

JUDGMENT

CH.MUHAMMAD MASOOD JAHANGIR, J.— Muhammad Shafi the husband of the appellant was insured against a policy No. 604004994-9 commencing from 31-8-2007 by the respondents, who took his last breathe on 27-12-2007 and the claim was paid on 25-5-2012, but the liquidated damages were not paid. Then the appellant filed an application for recovery of liquidated damages regarding the said policy amounting to Rs.3,00,000 under section 118 of the Insurance Ordinance, 2000 on 18-9-2012 till realization against respondents Nos.1 and 2. The said application was resisted by respondents Nos. 1 and 2, issues were framed and the parties were invited to lead their evidence. In the meanwhile, the respondents Nos.1 and 2 filed an application under Order VII, rule 11, C.P.C. for rejection of the main application filed by the appellant. The learned Tribunal/respondent No.3 vide order dated 17-3-2014 has allowed the said application and rejected the main insurance application being hopelessly time barred.

2. The learned counsel for the appellant has argued that issue of limitation is a mixed question of law and fact and could not be decided without recording of evidence of the parties, but the learned Tribunal without adverting to the said aspect has erred in law and non-suited the appellant on the point of limitation while omitting to consider that the cause of action accrued to the appellant on 25-5-2012 when the original claim was paid without liquidated damages which was the implied term of the contract in lieu of section 1918 of the Insurance Ordinance, 2000. It is further contended that in the present case section 19 of the Limitation Act, 1908 is applicable as fresh period of limitation was to be commuted from the date of acknowledgment i.e. 23-2-2009, which expired on 22-2-2012, but thereafter claim amounting to Rs.3,15,000 was paid without liquidated damages on 25-5-2012, which amounted to acknowledgment of liability with the result that fresh period of limitation started from the said date, therefore, the application filed by the appellant was still within time, but the appellant has been technically knocked out by the learned trial court while omitting to take into consideration the said aspect of the case, which has rendered the impugned order wholly illegal and without jurisdiction. Also contends that verdict of Full Bench of this Court reported as Mst. Robina Bibi V. Stated Life Insurance Corporation of Pakistan (2013 CLD 477), relied upon by the learned Tribunal in the impugned order is not applicable to the facts and circumstances of the present case as the cases called in question therein were decided after full fledged trial whereas the appellant has been technically knocked out without affording her opportunity to prove her version by leading evidence. He has next contended that the concept of computation of limitation is merely a mode of calculating period of limitation by excluding time which is permitted to be excluded under Limitation Act and without affording any opportunity to explain bona fide delay on the part of appellant the learned Tribunal erred in law while rejecting the claim. He has lastly prayed that while allowing this appeal, the impugned order be set aside and the matter be remanded to the learned Tribunal for decision on merits.

3. On the other hand, the learned counsel for the respondent No. 2 has resisted this appeal and supported the impugned order.

4. Arguments heard and record perused.

5. There is no denial that the Insurance Policy commenced on 31-8-2007 whereas the insurer died on 27-12-2007 and the claim of appellant was repudiated on 25-11-2008 by the respondent No.2. Feeling aggrieved the appellant filed a complaint before the Federal Ombudsman on 3-2-2009 and the said proceedings were concluded on 6-2-2010 in compliance whereof the claim amounting to Rs.3,15,000 was paid to the appellant by respondents Nos.1 and 2 on 25-2-2012. We are in agreement with the learned counsel for the appellant that fresh period of limitation was to be computed from 25-2-2012 when claim amounting to Rs.3,15,000 was paid without liquidated damages on 25-5-2012 as the same amounted to acknowledgment of liability and section 19 of the Limitation Act, 1908 was applicable. For ready reference the said provision is reproduced hereunder:–

“19. Effect of acknowledgment in writing.—(1) Where, before the expiration of the period prescribed for a suit or application in respect of any property or right, an acknowledgment of liability in respect of such property or right has been made in writing signed by the party against whom such property or right is claimed, or by some person through whom he derives title or liability, a fresh period of limitation shall be computed from the time when the acknowledgment was so signed.

(2) Where the writing containing the acknowledgment is undated, oral evidence may be given of the time when it was signed; but, subject to the provision of the Evidence, Act, 1872, oral evidence of its contents shall not be received.

Explanation I, for the purposes of this section an acknowledgment may be sufficient through it, units to spec; the exact nature of the property or right, or avers that the time for payment, delivery performance or enjoyment has not yet come, or is accompanied by a refusal to pay, deliver, deform or permit to enjoy, or is coupled with a claim to a set-off or is addressed to a person other than the person entitled to the property or right.

Explanation II. For the purposes of this section, “signed” means signed either personally or by an agent duly authorized in this behalf.

Explanation III. For the purposes of this section an application for the executive of a decree or order is an application in respect of a right. :

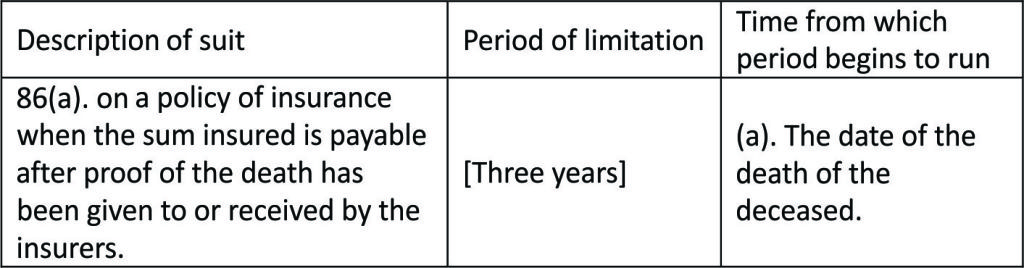

However, the learned Tribunal / respondent No. 3 omitted to take into consideration the said aspect of the case. Even otherwise, the limitation is a mixed question of facts and law and the same cannot be adjudged without recording of evidence. The learned Tribunal failed to consider the applicability of section 19 of the Limitation Act, 1908 and the application filed by the appellant could not be summarily rejected while applying Article 86(a) of the Limitation Act, which provides a limitation of three years from the date of death of the insurer. To our mind Article 86(a) ibid would be applicable, if his claim was payable, whereas in the present: case the claim of the appellant was repudiated by the insurance Company (respondent No.2), but this aspect has been totally ignored by the learned Tribunal while passing the impugned order is not applicable to the facts and circumstances of the instant case as said verdict was given in the case of final adjudication and applicability of section 14 and 19 of the Limitation Act, 1908 was also not discussed.

6. Consequently the instant appeal is allowed, the impugned order is set aside and the application filed by the appellant will be deemed to be pending before the learned Tribunal, who will decide the same afresh in the terms noted above. The parties are directed to appear before the learned Tribunal on 9-2-2015.

KMZ/S-14/L

Case remanded.

…………………………………………………………………………………………………………………………..

Published in 2nd Quarter 2017

2015 C L D 595

[Lahore]

Before Muhammad Khalid Mehmood Khan and Ibad-ur-Rehman Lodhi, J.J

Mst. INAYAT BEGUM—Appellant

Versus

STATE LIFE INSURANCE CORPORATE through Chairman and another—Respondents

Regular First Appeal No. 187 of 2008, decided on 17the December, 2014.

(a) Insurance Ordinance (XXXIX of 2000)—

—Ss. 118, 121 & 124—Limitation Act (IX of 1908), Art. 86(2)—Life insurance claim—Computation of period of limitation for filing of claim/application before the Insurance Tribunal under S.118 of the Insurance Ordinance, 2000—Scope—Deceased died on 9-7-2003 and claimant filed application under S. 118 of the Insurance Ordinance, 2000 on 31-7-2006; and such claim was held to be barred by time in view of Art. 86(2) of the Limitation Act, 1908—Validity—Period of three years notwithstanding the entries made in column No. 3 of Art.86(a) of the Limitation Act, 1908 would start from the point of time, when the proof of death of the insured had been given to or received by the insurer; and when merits of the case were adjudged on such provision of law—When on 17-6-2004, fact of death of Insured was placed before the Insurance Corporation; it was the point of time from where period of limitation was to be started for filing of an application under S.118 of the Insurance Ordinance, 2000 before the Insurance Tribunal—Application of claimant was therefore within time and claimant was wrongly made victim of limitation—High Court set aside impugned order of Insurance Tribunal and allowed application of the claimant—Appeal was allowed, accordingly.

(b) Insurance Ordinance (XXXIX of 2000)—

—Preamble & S.118—Insurance laws—Deficiencies—No Period of time prescribed in which claim had to be decided by the Insurance Corporation or an Insurance Company—Unbridled power available with Insurance Corporations to keep claims pending for an indefinite period of time—High Court observed that there was need for necessary legislation and amendment in the Insurance Ordinance, 2000—Comparative legislation and principles examined—Recommendations and proposals for legislative reforms outlined.

Liaqat Ali Butt for Appellant.

Ali Akbar Qureshi and Ibrar Ahmad with Safdar Ali Qureshi, Law Officer for Respondents.

Date of hearing: 11th September, 2014.

JUDGMENT

IBAD-UR-REHMAN LODHI, J.— This is an appeal under section 124(2) of the Insurance Ordinance, 2000, arising out of the judgment, passed by the learned Insurance Tribunal Punjab, Lahore, on 31-3-2008, whereby, the application of present appellant Mst. Inayat Begum, for recovery of death claim along with liquidated damages, was dismissed being barred by time.

2. Nasir Hussain, son of the appellant, purchased two insurance policies during his life time on 1-7-2001 and 1-12-2002, respectively. He reportedly died on 9-7-2003. After his death, the claim by the appellant was filed on 17-6-2004 with respect to both the above noted policies, which was not accepted by the Insurance Corporation and it was held to have been repudiated.

3. The Insurance Tribunal was established on 20-6-2006. At the relevant time, there was no specific remedy available to the aggrieved legal heir of deceased insured and, therefore, a complaint was filed by the appellant before the Federal Ombudsman, which was declined on 1-12-2005. Writ Petition No. 6735 of 2005, calling in question, such findings was dismissed by this Court on 27-4-2005. From the refusal on the part of the Federal Ombudsman, a representation was also filed before the President of Pakistan, which was also dismissed on 25-2-2006. In the meanwhile, as noted hereinabove, the Insurance Tribunals were established under the Insurance Ordinance, 2000, w.e.f. 20-6-2006 and, therefore, an application under section 118 of the Insurance Ordinance, 2000, was filed by the appellant on 31-7-2006.

4. In addition to other issues, the learned Tribunal also proceeded to frame Issue No.1 touching the limitation for filing any application seeking death claim along with liquidated damages in view of Article 86(a) of the Limitation Act, 1908.

5. Although the Insurance Corporation has contested the plea of the appellant on merits also, but for the reason that before the Tribunal, no evidence, except one R.W.1 was produced, who even was not an Inquiry Officer on behalf of the Insurance Corporation on the basis of which, the policies of the deceased insured were refused to be encashed in favour of the appellant. Even though the witnesses, stated to have been appeared before the Inquiry Officer, did not appear before the Tribunal in witness box. No evidence showing the ailment of the deceased insured at the time of obtaining the policies was made part of the record; only on the basis of general observations that the Insurance Corporation had sufficient material with it justifying the bad health of the deceased insured at the time of purchase of policies, the claim of the appellant was refused.

6. Even the appellant was hit on the point of limitation on the basis of wrong interpretation of Article 86(a) of the Limitation Act, 1908. For ready reference, Article 86(a) of the Limitation Act, 1908, is reproduced herein below:–

The careful reading of the above provision of law reveals that the period of three years notwithstanding the entries made in Column No.3 of such Article would start from the point of time, when the proof of the death of insured has been given to or received by the insurer, and when the merits of present case are adjudged on the touchstone of such provision of law, it would abundantly clear that, when on 17-6-2004, through claim, when the fact of death of the insured was, for the first time, placed before the Insurance Corporation, it was the point of time from-where the period of limitation was to be started for the appellant for filing an application under section 118 of the Insurance Ordinance, 2000 before the Tribunal. The application filed on 31-7-2006 was, thus, within time from 12-6-2004,and the appellant was illegally made victim of the law of limitation on the basis of wrong interpretation of the relevant provision.

7. We have noted, with concern, that in the Insurance Ordinance, 2000, although a power to scrutinize the claim of the claimants/LRs of deceased-insured, has been provided to the Insurance Company, but no period of time has been prescribed as to in which such claim has to be decided either way by the Insurance Company.

Section 4(1) of the Service Tribunals Act, 1973 provides that any civil servant aggrieved by any order, whether original or appellate, made by a departmental authority in respect of any of the terms and condition of his service may, within thirty days of the communication of such order to him, prefer an appeal to the Tribunal, whereas, in view of section 4(1)(a) of the said Act, it has been provided that, where an appeal, review or representation to a departmental authority is provided under the Civil Servants Ordinance, 1973, or any rule against any such order, no appeal shall lie to a Tribunal unless the aggrieved civil servant has preferred an appeal or application for review of representation to such departmental authority and a period of ninety days has elapsed from the date on which such appeal, application or representation was so preferred.

This clearly indicates that whenever in any scheme of law, the departmental authority has been given a power to review its own decision, a stipulated time has been provided to such departmental authority and in case within such stipulated time, the matter pending before such authority is not decided, the aggrieved person would be entitled to prefer his appeal before the available legal forum constituted specifically in that regard.

No such parallel provisions have been provided in Insurance Laws and once a claim is filed before the Insurance Company by the LRs of deceased-insured, the Insurance Company has not been bound down with reference to a time limit within which the matter or claim placed before it, is to be decided or after expiry of the same, interested person would be competent to approach the Insurance Tribunal.

In the circumstances, when the authorities or the departments are given the power to review their own decision, in fact, the role of a Judge has been assigned to their own cause, and such power must not to be unfettered of unbridled and at least should be checked through the restraints of time limit.

Similarly, in labour laws, a workman aggrieved of any adverse order passed against him can competently issue a grievance notice to the employer and certain period of limitation has been provided for the employer to decide either way such grievance notice and like service matters, if within such certain period of limitation as provided under section 33 of the Industrial Relations Act,2012, the employer has failed to decide the grievance notice, it would be deemed that the same has been answered in negative and, thus, the workman would be competent to seek his remedy by filing a grievance petition before the concerned Labour Court within certain period of limitation, after such deeming refusal on the part of the employer.

8. Here in the insurance laws, we find nothing of the kind of such parallel provision and in our view, the Insurance Companies/ Corporation have been given unbridled power to keep the claims pending with them for an indefinite period and, if the authorities sitting in the Corporation, want to use the same, as a tool to deprive the claimants from their legitimate right, the limitation period of three years may also be exhausted resulting into frustration of the claim of the concerned interested person to be filed before the Insurance Tribunal within a period of three years as provided under Article 86(a) of the Limitation Act, 1908; therefore, we suggest necessary legislation to be introduced by the Ministry of Law resulting into suitable amendment in section 118 of the Insurance Ordinance, 2000, providing certain limitation for Insurance Companies/ Corporation, regarding decision on claim of the legal heirs of deceased insured within certain period and if within such period, such claim is not decided, it would be deemed that the same has been refused and, thus, the aggrieved persons would have a right to approach the Insurance Tribunal by moving an application under section 118 of the Insurance Ordinance,2000.

The Insurance laws, as are available in the prevailing condition are in the nature that the same provided unlimited time to the Insurance Company to withhold the claims of the aggrieved persons under the name of scrutiny or examination and it is left open to the Insurance Company to exhaust the period of limitation as has been provided for any aggrieved person to approach the Tribunal in order to redress his remedy. In certain cased, it has been noticed that with motivated intention the claim has remedy. In certain cases, it has been noticed that with motivated intention the claim has been withheld by the Insurance Company till the expiry of period of limitation provided under Article 86(a) of the Limitation Act, 1908, and thus, on being satisfied that the time limit provided in the relevant law had expired, the aggrieved person or persons are intimated about redundancy of their insurance claims, thus, practically making the aggrieved persons out of time for approaching the concerned Insurance Tribunal. This cannot be termed as a good law and need attention of the Legislature to convert the same into a beneficial and good law.

9. Copy of this judgment is, therefore, ordered to be delivered to the Secretary Law, Ministry of Law, Justice and Parliamentary Affairs (Justice Division), Islamabad, for taking appropriate legislative measures in the lines, as noted hereinabove.

10. For reason that we are not in agreement with the findings of the Insurance Tribunal both on merits, as well as, on the point of limitation, the present appeal is allowed and the application moved by the appellant before the Insurance Tribunal stand allowed.

KMZ/I-1/L

Appeal allowed.

…………………………………………………………………………………………………………………………..

Published in 1st Quarter 2017

2015 C L D 1254

[Lahore]

Before Shams Mehmood Mirza, J

POSTAL LIFE INSURANCE through General Manager—Petitioner

Versus

MUHAMMAD ISHAQ BUTT and another—Respondents

W.P. No. 11248 of 2014, heard on 9th December, 2014.

Insurance Ordinance (XXXIX of 2000)—

—Ss. 171(1), 171(2), 2(xxxi), & 118—Pakistan Postal Services Management Board Ordinance (CXXVI of 2002) Ss. 3 & 11—Civil Procedure Code (V of 1908), O. VII R.11—Constitution of Pakistan, Art. 199—Constitutional petition—Jurisdiction of the Insurance Tribunal—“Insurer”, meaning of—Exemptions under S. 171 of the Insurance Ordinance, 2000—Scope—Question before the High Court was whether the petitioner Postal Life Insurance, was amenable to the jurisdiction of the Insurance Tribunal under the Insurance Ordinance, 2000—Contention of the petitioner Postal Life Insurance was, inter alia, that since it was run by the Federal Government, it fell under the exemption created by S. 171 of the Insurance Ordinance, 2000—Held, that under S. 2(xxxi) of the Insurance Ordinance, 2000 any company incorporated under the Companies Ordinance, 1984 or a body corporate incorporated under any law carrying on the business of insurance came within the purview and jurisdiction of the Insurance Tribunal— although S. 171 (1) of the Insurance Ordinance, 2000 made it clear that provisions of the Insurance Ordinance, 2000 were not to apply to any insurance business carried on by the Federal Government or Provincial Government, however, S. 171(2) of the insurance Ordinance, 2000 created an exception to the effect that insurance business carried out by a body corporate, even if controlled by the Federal Government; shall not be deemed to be insurance business carried out by the Federal Government—Per Ss. 3 & 11 of the Pakistan Postal Services Management Board Ordinance, 2002; the Board of the Postal Life Insurance was body corporate and squarely fell within the exception created by S. 171 (2) of the Insurance Ordinance, 2000—Fact that petitioner was not registered with the Securities and Exchange Commission of Pakistan did not in any manner effect or had a bearing on jurisdiction of the Insurance Tribunal—High Court observed that a combined reading of Ss. 2(xxxi) & 171 of the Insurance Ordinance, 2000 together with Ss. 3 & 11 of the Pakistan Postal Services Management Board Ordinance, 2002; made it clear that the petitioner was amenable to jurisdiction of the Insurance Tribunal—Impugned order was therefore, rightly passed—Constitutional petition was dismissed, in circumstances.

Muhammad Amir Sohail for Petitioner.

Liaqat Ali Butt for Respondents.

Date of hearing: 9th December. 2014.

JUDGMENT

SHAMS MEHMOOD MIRZA, J— Through this writ petition, the petitioner, Postal Life Insurance, has challenged the assumption of jurisdiction by Insurance Tribunal, Lahore on the petition filed by respondent No.1 and order dated 8-4-2014 whereby the application filed by the petitioner under VII, Rule 11, C.P.C was dismissed.

2. The facts of the case are simple and need not be elaborately stated. The legal question to be determined by this Court is whether the petitioner is amenable to the jurisdiction of the Insurance Tribunal. The brother of respondent No.1 brought an insurance policy bearing No.CL-(A) 03460-LHB dated 15-8-2005 from the petitioner. On his death, respondent No.1 lodged the insurance claim with the petitioner which was repudiated on 1-7-2010. This compelled respondent No.1 to file a petition before the Insurance Tribunal, Punjab, Lahore seeking redressal of his grievance. The petitioner on being summoned filed an application under Order VII, Rule 11, C.P.C. before the Insurance Tribunal, Punjab, Lahore for dismissed on 8-4-2014.

3. The core issue raised by the petitioner’s counsel is that the petitioner being run by the Federal Government does not come within the jurisdiction of Insurance Tribunal in terms of section 171(1) of the Insurance Ordinance, 2000 (the Ordinance). It was further stated that by virtue of the Rules of Business, the petitioner is placed under the Ministry of Commerce and as such the Insurance Tribunal had no jurisdiction over it. It was also submitted that the petitioner is run under Post Office Insurance Fund Rules, 2000 and it is not registered with the Securities and Exchange Commission of Pakistan. The learned counsel, for the petitioner also referred to the definition of “insurer” as mentioned in section 2(xxxi) of the Insurance Ordinance, 2000 to argue that the petitioner is neither a company nor a body corporate and as such does not fall within the jurisdiction of Insurance Tribunal.

4. Section 2 (xxxi) of the Insurance Tribunal Ordinance, 2000 defines “insurer” and reads as under:-

“insurer” means

(i) Any company or other body corporate carrying on the business of insurance, which is a company or other body corporate incorporated under any law for the time being in force in Pakistan: and

(ii) Any body corporate incorporated under the law of any jurisdiction outside Pakistan carrying on insurance business which carries on that business in Pakistan.

Section 171 of the Ordinance reads as under:-

Exemptions —(1) Nothing in this Ordinance shall apply to any insurance business carried on by the Federal or by a Provincial Government.

(2) For the purposes of this section, insurance business carried on y a body corporate shall not be deemed to be insurance business carried on by the Federal or by a Provincial Government by virtue only of the fact that the Federal or Provincial Government holds a controlling interest in the body corporate.

The aforementioned provisions together with section 2(xiv) of the Ordinance show that any company incorporated under the Companies Ordinance, 1984 or a body corporate incorporated under any law carrying on the business of insurance comes within the purview and jurisdiction of the Insurance Tribunal.

5. Although section 17(1) of the Ordinance makes it clear that the provisions of the Ordinance shall not apply to any insurance business carried on by the Federal or by a Provincial Government, subsection (2) thereof creates an exception to the effect that the insurance business carried out by a body corporate even if controlled by Federal Government shall not be deemed to be insurance business carried out by Federal Government.

6. In regard to the question whether the petitioner is being run by the Federal Government and therefore, the jurisdiction of the Insurance Tribunal is ousted, the provisions of the Pakistan Postal Service Management Board Ordinance, 2002 (Ordinance No. CXXVI of 2002) are quite instructive and clearly bring out the fact that the petitioner falls squarely within the exception contained in subsection (2) of section 171 of the Ordinance. By virtue of section 3 of Ordinance No. CXXVI of 2002, Pakistan Postal Services Management Board (the Board) was created. In terms of section 3(2) thereof, the Board is a body corporate having perpetual succession, a common seal and has the power to acquire, hold and dispose of property and can sue and be sued in its own name. Section 11 of the said ordinance enumerates the powers and functions of the said Board, which include the power to manage, maintain and operate the petitioner, Postal Life Insurance, throughout Pakistan.

7. It is thus clear that the insurance business of the petitioner is being run, managed and carried on by the Board, which is a body corporate having been established under Ordinance No. CXXVI of 2002. The petitioner thus falls in the exception created by section 171 (2) of the Ordinance. The fact that the petitioner is not registered with Securities and Exchange Commission of Pakistan does not in any manner effect or has a bearing on the jurisdiction of the Insurance Tribunal. By a combined reading of section 2(xxxi) and 171(2) of the Ordinance read with section 3 and 11 of the Ordinance No. CXXVI of 2002, the petitioner is amenable to the jurisdiction of the Insurance Tribunal.

8. the Insurance Tribunal thus rightly passed order dated 8-4-2014 dismissing the petitioner’s application filed under Order VII, Rule 11, C.P.C this writ petition being devoid of any merit is accordingly dismissed.

KMZ/P-4/L

Petition dismissed.